The Money and Pensions Service (MaPS) developed a new communication system (NCS) designed to reduce the number of people missing pre-booked appointments using behavioural change techniques.

The NCS was developed with feedback from the debt advice sector and is the result of collaborative efforts with debt advice providers, which enabled them to identify the challenges and work out solutions together to implement the NCS within existing business operations. The NCS is designed to increase the efficiency of debt advice by enhancing communications between providers and clients, however it is equally as relevant for the delivery of pre-booked money or pension guidance services too.

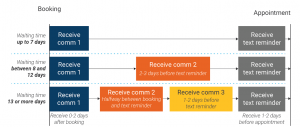

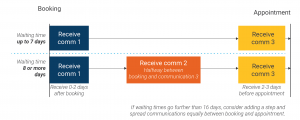

The system consists of sending up to three communications in advance of an appointment using specific templates. The templates are designed to elicit greater commitment, make key message salient and reduce the complexity of the tasks involved. The templates are available for download below to enable providers adopt the NCS promptly.

It is our hope that our findings will influence change across the advice and guidance sector by reducing no-shows and helping more people.

The background

When a client/customer doesn’t attend an advice or guidance appointment (‘no shows’), it means they are not receiving (or at least delaying receiving) help which can dramatically improve their financial circumstances.

Advisers and guiders also have to prepare for each appointment, so every ‘no show’ not only wastes the time spent planning, but also the time reserved for the appointment itself. Among participants in this intervention, the pre-existing ‘no show’ rate for debt advice appointments was 24%.

The impact

Eight debt advice participant organisations were involved in the intervention which lasted for approximately five months. The results of the intervention were clear – with the NCS in place there was a significant reduction in the number of missed appointments by almost a quarter (24%). At the same time, attendance overall increased, as did cancellations.

How the NCS works

The illustrations below summarise how to implement the NCS. Depending on waiting times and the availability of text reminders, the number of communications vary. The structure proposed was developed from the learnings and the recommendations captured from the impact evaluation and interviews with frontline staff and clients.

The templates for all communications are included in our toolkit, available for download below. Please note that timings consider the moment when the communications are received; this means that if clients/customers are contacted by post, the communications should be sent at a time factoring in possible delays in delivery.

The templates are provided for email, post and text reminders. We encourage providers to identify and adopt a clients’/customers’ preferred channel of communication on an individual basis.

Wider application – the NCS beyond pre-booked appointments

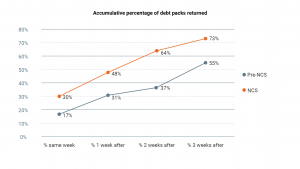

The NCS is designed to be flexible. This same approach was also successful for other parts of the debt advice process and not only for pre-booked appointments.

At one provider, similar techniques were used to increase the number of clients returning information required in order to progress their case to their adviser. By sending additional reminders in accordance with the NCS, the returns increased by 34% overall, while those being returned in the same week increased by around 80%.

Download the toolkit and the templates

The toolkit is available to download here. This includes templates for email, post and SMS communication alongside a guide to use the NCS and identify the key behavioural change elements used in the templates.

We encourage debt advice providers to look at our evaluation report and use the learnings with the toolkit provided to review their current communications with clients.

You also may find useful to look at our guide for 10 more ways to use behavioural science to increase the uptake of debt advice using behavioural change techniques which can be found here.

Innovate with us! For more information about this resource or to get involved in our innovation projects, please contact MaPS innovation team at Innovatingtogether@maps.org.uk